We’ve seen successful investors draw on different types of skills. Some are handy and can build sweat equity by doing parts of their rehab themselves. Others are negotiators and managers extraordinaire. They are the ones who squeeze every penny, negotiate for every nail, and breathe down the neck of their contractors every day. Working with them is not a picnic for contractors, but those investors do make money when their softer competitors don’t. Still, regardless of their skills, all of those investors share a single strength in common: an ability to find real estate investment opportunities. Identifying properties with money-making potential and putting them under contract is at the heart of real estate investing.

This article is a continuation of our series on this topic. For more information see our previously-published Introduction and our article on Finding Real Estate Deals at Foreclosure Auctions.

When a property fails to sell at a foreclosure auction, it goes back to the bank that holds the nonperforming mortgage. The bank becomes its owner (thus Real Estate Owned or “REO”), and the previous owner, who was not paying the mortgage, is taken off the title. As the new owner, the bank can do anything it wants with the property. Since they are not in the property management business, most banks choose to sell those properties off.

REOs are frequently touted as the holy grail of real estate investing. They are also often equated with “distressed” properties. There are good reasons for this.

What Makes REO such a good investment opportunity?

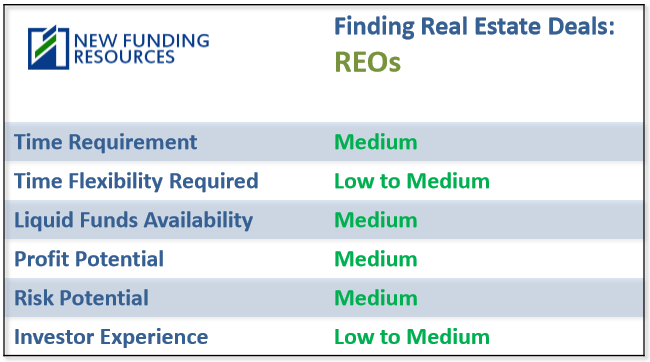

Investing in Real Estate Owned (REO) properties can present several potential advantages for investors who are well-prepared and understand the market dynamics:

- Potential for Below Market Value Pricing: REOs are non-owner-occupied. The owner (aka bank) is a motivated seller with a vacant property on its hands. Every day that property is sitting on the market, the bank incurs real estate taxes, property insurance, and maintenance costs. This is why REO properties are often priced below their market value. Lenders typically want to sell these properties quickly to recover their investment, which can create opportunities for investors to purchase properties at a discount.

- Negotiation Flexibility: Unlike traditional home sellers, banks and lenders may be more open to negotiating prices and terms, especially if the property has been on the market for a while. This can potentially allow investors to secure a better deal.

- Opportunity for Renovation and Value Addition: Many REO properties are sold in as-is condition and may require repairs or renovations. Investors who are willing to invest in upgrading the property can potentially increase its value, either through resale or rental income.

- Less Competition: While REO properties can attract multiple buyers, they may also have less competition compared to traditional market listings, especially if the property requires significant repairs or is in less desirable condition.

- Clear Title: Typically, REO properties come with a clear title, free of liens, back taxes or other title defects, which simplifies the buying process and reduces the risk of legal complications post-purchase.

Despite all these REO advantages, I cringe every time I hear that banks will sell their REOs for pennies on the dollar. Banks might be motivated sellers, but they are not naïve. Their REO-disposition departments are tasked with researching the market values and pricing their properties accordingly. REOs are typically listed in MLS, which means you are not the only one seeing it. The better the deal, the higher the chances you will encounter stiff competition from other investors. The bottom line is that being an REO is by far not a guarantee of a bargain. Making money buying REOs is not easy. However, as a private lender I’ve seen it done many times. You need experience, perseverance and craftiness.

Here are a few suggestions on how to succeed buying REOs:

- Cash rules: Just like any other seller of vacant property, banks want to sell fast. They know that obtaining financing is a long and complicated process with no guarantee of approval at the end. For these reasons, they prefer to work with all-cash buyers. A private mortgage lender like us can issue you a proof of funds letter that is equivalent to a cash offer and will allow you to stand out from the crowd.

- Look for REOs that’s been sitting on the market. Now that you got your hard money proof-of-funds letter in your pocket, it’s time to get more nuanced. One of the best ways to get an REO bargain is to identify properties that are not selling quickly. It’s safe to assume two things about those properties. First, for one reason or another there are not a lot of buyers knocking at their doors – perhaps the bank priced the property too high so it just sat on the market, so competition might be light. Second, the bank must be getting anxious to sell. It all means that you have a decent leverage to negotiate a lower price and should not be shy to doing it. A pre-approval for a hard money loan should already give you a leg up on your competition, but there are additional things that can strengthen your chances.

- Justify the lower price. When negotiating a lower price don’t just say that the current price is “too high for a property in a given condition” – document it. Give the bank a compelling reason to lower it by listing all that’s wrong with the property and the amount of money required to fix it. Without being rude or condescending, help them see that the current price is unrealistic and they would be better off selling it to a well-heeled investor like you.

- Choose your timing wisely. In my 11 years as a private mortgage lender, I’ve seen many tricks of the trade, and I love this one. Make your REO offers between Thanksgiving and Christmas. It is typically a dead season, with many buyers going dormant until the beginning of the year. At the same time, banks are under pressure to get rid of the properties before the end of the year and make their annual goals. Play your cards correctly, and who knows? With some good luck and perseverance, Santa might bring a nice real estate deal for you.

Now let’s shift the conversation from the properties that are languishing on the market to those that are hot, hot, hot. If you want to increase the chances for your offer to be accepted, it’s time to step it up. This is how you do it:

Offer to close quickly.

Let them know that you are a serious buyer pre-approved with a private mortgage lender and can close in a week or so. I doubt that a bank selling your REO can move that fast, but this isn’t your issue. Your goal is stand out from the competition and present yourself as a strong well-capitalized buyer that means business.

Make an oddball offer.

Most people submit a round number offers: $105,000, $250,000, etc. Mix things up and make a different offer. Incorporate your birthday or your lucky number. The reason behind this idea is that if someone else is bidding $105,000 you would be the highest bidder if your offer is $105,317. Not a bad return for an additional $317. Also, the bank might think you have a solid reason behind your odd number offer.

Offer a larger deposit.

Another way to stand out is to offer a larger deposit. It demonstrates your financial strength and weeds out a portion of the competition who cannot afford to match you. For example, wholesalers that might be competing with you typically offer small deposits of as little as a couple of thousands of dollars. When competition is tough, and you must come out with all guns a-blasting, aim to offer at least 10% of the property value.

Waive Inspections

As a private mortgage lender, I can’t warn you enough: this option is not for novices. Banks love to see the inspections waived and for obvious reasons. If you later discover a significant defect, you can only walk away by forfeiting your deposit. A reasonable alternative for waiving the inspection is decreasing the normal inspection period to 3-5 days. It both protects you from unnecessary risk and shows the bank that you are serious.

Be ready to walk away.

Regardless of your potential investment source, always be ready to walk away. Do not get emotionally involved with the property. A sign of a mature investor is the ability to disengage and let someone else make a mistake. See our previous blog on the 5 signs of immature investors.

Conclusion

Investing in REO properties can be a lucrative strategy for real estate investors, offering opportunities to purchase properties at discounted prices and potentially achieve high returns through resale or rental income. However, it’s essential to conduct thorough due diligence, assess the property’s condition, and understand the local real estate market to mitigate risks and maximize investment returns.

New Funding Resources LLC is a private mortgage lender doing business in Maryland, DC and Virginia. We offer private loans that help you compete against cash offers and make money in real estate. Click here to learn more or apply here.

New Funding Resources

New Funding Resources

There’s an REO here in my area, just 2 miles from a current project of mine, that has been languishing on the market and the bank is now asking $245,000. There are no appliances, some sabotage damage on the way out, but basically a good, quick flip. I want to offer $150,000 and then price at $295 with a compromised sale price of $279,000. I believe I can make necessary repairs and improvements for under $30,000. Is this something you can help me with?

Yes Wally, that’s definitely looks like a deal we can help you with – if the property is located in MD, DC or VA. You can contact Anastasia for more details at 240.436.2340

Very informative. Thanks for the information.

Thanks Zebedee, good luck with your real estate investment strategy. Let us know how we can assist or what other topics you would like us to highlight.