Our Process

“Lost Time Is Never Found Again” – Benjamin Franklin

In real estate, time is money. This is why we designed our process to offer maximum speed and flexibility while ensuring the overall soundness of your real estate investment project. With New Funding Resources, you will work directly with the decision-maker and have the attention of one of our skilled hard money underwriters. Our understanding of the local DMV real estate market and our experience in managing residential rehab and construction will help you make a competitive and timely offer, control your costs, and optimize your returns.

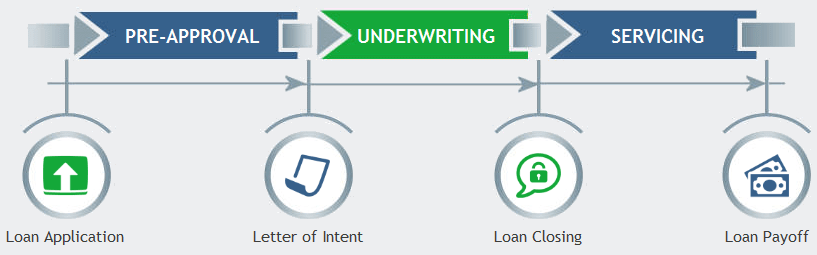

Hard Money Loan Lifecycle

From initial application to loan payoff, our process is transparent and designed with your success in mind.

Hard Money Loan Pre-Approval

Call us at 240-436-2340 or reach out to us online to initiate the conversation. Once we speak and determine the general fit, we will send you a detailed loan application to fill out. You don’t have to have a specific property in mind. We can issue you a general preapproval based on your investor profile and the capital you have available for investment purposes. The pre-approval provides guidance on which projects fit your budget and which might exceed it. It also informs the sellers that you have access to the funds needed and can close fast and hassle-free. The preapproval process takes between 24 and 48 hours. You can read more about our preapproval process here.

Hard Money Loan Underwriting

Once you have identified the property and your contract has been ratified, we can start the process of underwriting in earnest. It begins with issuing a Letter of Intent: a commitment to fund your loan on specific terms once the specific conditions are met. Our list of conditions is much shorter than what you might be used to. We verify the information you provided, take a closer look at the subject property and the work required, and ensure that your and our interests are protected from unexpected liens, claims, and calamities. Typically, we can close your loan within seven to ten business days.

Subject Property Review:

- Property Appraisal or BPO

- Scope of Work With Detailed Repairs, Materials and Labor Costs

- Plan of Construction / Rehab Draws

- Satisfactory Review of Title

- Proper Insurance, Typically Builder’s Risk Policy (When Applies)

Personal Info Review:

- Credit History Review

- Proof of Deposit to Verify Funds Available

- Proof of Reserves

- Proof of Employment / Income (Applies to Buy-and-Hold’s only)

Hard Money Loan Servicing

Once we fund your transaction, our collaboration does not stop. In fact, the work is just beginning! Since we base our loans on the after-repair value of the property, you will be doing your part in making sure the ongoing renovations steadily and surely increase that value. As you hit pre-determined milestones within your statement of work, we will be releasing the funds held in the construction escrow back to you. We will also be avaialble to advise you about your exist strategy, your construction quality, evaluate your selling price, or forwarn you about any potential risks to your project.

This process of working with a borrower after their transaction funds is called loan servicing. Its goal is to ensure that each party lives ups to its contractual responsibilities and, hopefully, that both parties generate profit they expected. At New Funding Resources, we dedicate substantial resources to our loan servicing and take pride in it. You can learn more about our loan servicing and how it can help increase your profits and minimize your risk here.

Our work together culminates in paying off our hard money loan either via the sale of the property or refinancing it with another lender. The title company facilitating the transaction would request the payoff statement from us that include the principle blaance of the loan plus all the interest due to us throughout the specific date. The title company than wires the funds to our bank. Once the funds are received, the loan is consideren paid off, and we remove our lien off the title.

New Funding Resources

New Funding Resources