Our hard money loans in Washington DC are designed to help you succeed!

We are a direct private hard money lender specializing in hard money financing in Washington, DC, and surrounding areas. Our reputation for reliability, transparency, and local expertise makes us one of the highest-reviewed private lenders in the DMV area. In business for over 17 years, we understand the intricacies of Washington, DC lending and work closely with our borrowers to manage their risk and increase their profits.

You might be looking for a way to make a quick profit by flipping a home in the DC area. Alternatively, you might have set your eyes on building long-term wealth by rehabbing and holding it in your rental portfolio. Regardless of your financial strategy, we can make our hard money loans fit right in. We underwrite holistically, meaning that we don’t let one single factor determine the approval or disapproval of your loan. Everybody has their strengths and weaknesses, and every hard money loan application has its pluses and minuses. As hard money lenders in Washington, DC, we will work with you to give you the best chance to succeed as a real estate rehabber regardless of your experience or the depth of your pockets.

If you’re looking for a cost-effective and reliable source of private funds for residential or commercial property renovation projects in Washington, DC, contact New Funding Resources today!

Why choose us as your hard money lenders in Washington, DC

We Work with a Sense of Urgency

We issue pre-approvals in 24 hours and can close your loan in 5 days or less. Our hard money loans are universally considered cash offers.

We Keep an Open Mind

We lend our own money and make our own underwriting decisions. We believe in the power of compensating factors. If your deal makes sense, we’ll find a way to make it work.

We Provide Favorable Terms

Washington, DC real estate is expensive. Whether you’re a new investor or an experienced rehabber, our hard money loans in Washington, DC will offer incredible leverage to take your business to the next level.

We Offer Unparalleled Support

We are a tightly-knit group of DC Metro real estate experts who work for you. Your transaction will be managed by a designated underwriter and you will always have easy access to a decision-maker.

We Take Pride in Local Expertise

We know the Washington DC market inside out. After sixteen years of lending here, we are deeply familiar with its unique challenges and opportunities. We’ll work closely with you to ensure your investment’s success.

We Provide Peace of Mind

In business since 2006, we’ve built our reputation on delivering on our promises. We work hard to keep your costs low and help you maximize your profits.

We love investing in Washington, DC market, and you should too!

Washington DC is a wonderful area to live and invest in. The DC area wealth and the job market’s reliance on the federal government insulate us from the economic booms and busts experienced by other areas. Despite the pandemic, D.C.’s median sale prices have risen to $682,500 as we end the year. This is an increase of 13.0% compared to July 2019 and 5.0% since June 2020. This strong performance is not an exception. Since 2007, Washington, DC’s real estate market experienced a steady appreciation that not quite doubled the price but came close to it. In 2020, along with record high home prices, the number of homes sold is up 20.1% year-over-year. The prices dropped slightly in 2023 but the market remains healthy and the inventory is low – giving the sellers the upper arm.

Many local experts continue to predict the strong market in 2023 while dismissing the real estate bubble concerns. Here are just a couple of opinion pieces.

For any questions about how our hard money loans in Washington, DC can help you make money in real estate investing, call New Funding Resources at 240.436.2340.

What makes New Funding Resources different from all other hard money lenders in Washington, DC?

You might be looking for a way to make a quick profit by flipping a home in the DC area. Alternatively, you might have set your eyes on building long-term wealth by rehabbing and holding it in your rental portfolio. Regardless of your financial strategy, we can make our hard money loans fit right in. We underwrite holistically meaning that we don’t let one single factor determine the approval or disapproval of your loan. Everybody has their strengths and weaknesses, and every hard money loan application has its pluses and minuses. As a hard money lender in Washington, DC, we will work with you to give you the best chance to succeed as a real estate rehabber regardless of your experience or the depth of your pockets.

One of the answers is our local focus. Investing in the DMV area is quite different from investing in Florida or California. Chances are you would not consider working with a real estate agent not specializing in the local market. So why work with a lender who is not familiar with our market and who doesn’t have a clue as to how to manage a rehab project in the nation capital? We operate exclusively in Washington, DC, Maryland, and Virginia. Yet, we are also acutely aware that real estate investor in Washington, DC might face challenges that are dramatically different from challenges facing a Baltimore or Chantilly investor.

This is why we don’t just lend you money – that part is easy. What makes us different is that we make sure that you succeed with each and every transaction we finance. We do it in several ways:

- Pro-actively remove third party biases in determining the after-repair value of your project. In other words, let’s have an authentic discussion of how much you can get for your renovated property in the current Washington, DC real estate market.

- We are the experts on buying at foreclosure auctions. If you are considering a property offered for an auction, talk to our managing partner, Kyle Sennott. He is a premier expert in this area.

- We offer a variety of tools created specifically for the DMV market. Take our hard money calculator for a spin to determine your profit, ROI, and possible contribution to the transaction. Or check out our maximum purchase price calculator, a unique and nifty tool that helps set a maximum purchase price based on the minimum amount of profit you are willing to accept.

- We help you set and manage your rehab process. We would let you know how realistic your rehab budget is and consult with you on whether your construction scope warrants getting permits or not. It’s ultimately your business to manage, but our local expertise will help you minimize your risk and maximize your profit.

What is so different about investing in Washington, DC real estate market?

The Washington, DC real estate market in booming. In fact, it’s consistently rated as one of the top most expensive cities in the USA. For a real estate investor, it means that doing business there is rather costly. Don’t take us wrong – the return on investment there is awesome. But you better have deep pockets to operate business there.

You also need patience. A lot of it. The DC inventory is tight and competition among investors is severe. As the Washingtonian Magazine put it in their article “People in Washington these days don’t really buy houses. They win them.” If you are planning to score a fixer-upper there, prepare yourself for a long run and many offers that would be outbid by others.

Rehabbing properties in Washington, DC tends to be a complex and prolonged affair. Construction permits are often required and typically take a long time to obtain. Let’s discuss early in the process which permits to request and how to manage that process effectively. Bear in mind, the permitting process in Washington, DC is notoriously slow, so budget your time accordingly.

Renovating homes in Washington, DC is not for complete novices. It require taste, knowledge of the most recent design trends, and a reliable crew that is both fast and quality-oriented. While it doesn’t mean that each DC property needs to look like Jeff Bezos’ Kalorama mansion, the standards are high.

While a number of our brand-new investor clients have done exceptionally well in DC, this market lends itself better to those with experience and resources. For those investors, the rewards of investing in the nation’s capital are significant. Condo conversion opportunities offer unique ways to increase a transaction’s ROI. Rapidly growing and changing areas are seeing more affluent buyers clamoring for newly renovated homes. Steady appreciation provides a significant tailwind. Washington, DC is truly a smart investor paradise and will likely continue to be for years to come.

Ready to tackle your next flip in DC? Get pre-approved with us.

If you are interested in investing in DC, but not sure how much you can afford, it might be a good idea to get pre-approved for a loan. With us, it’s easy, quick, and free. Knowing your price ceiling helps focus your search on a particular type of home and on a particular type of rehab. For example, to convert a DC townhouse into a swanky condominium, would require more capital than you can afford or care to invest. In this case, you might be better served with a renovation that is more cosmetic than structural.

Once you are ready to start making offers, you will need a proof-of-funds letter. Proof of funds is a document that states that you’re pre-approved for a hard money loan with a reputable private lender. Our proof of funds letters are considered cash offers, so you can effectively compete even with the most well-heeled investors.

As the top hard money lenders in Washington, DC, we guarantee to offer both excellent terms and local expertise to improve your bottom line. Call us today at 240-436-2340.

Our Washington, DC-based projects: Before and After

Adams St. NE

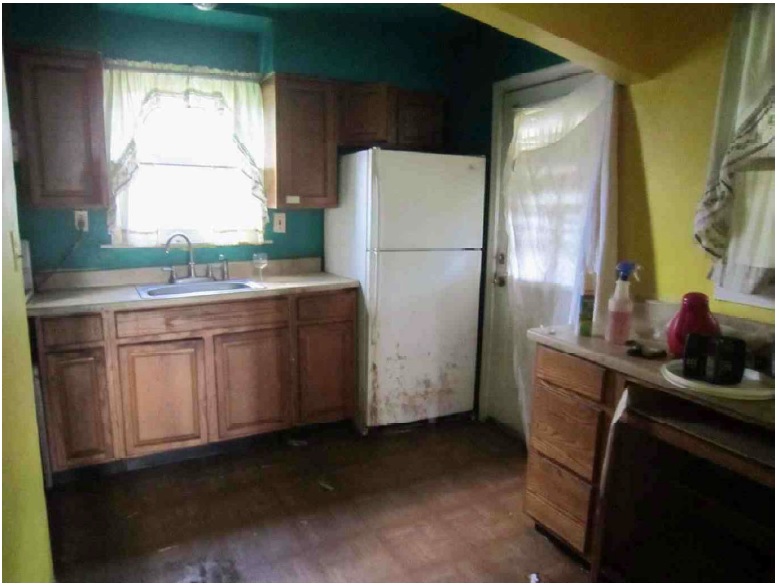

Before:

Our client has certainly worked hard on this property in NE Wasington, DC. Everything had to be redone. Plus, you had to have a vision to meet today’s market disserning standards!

After:

From the opened layout to meticulously crafted detains, to tasteful staging, this client outdid herself.

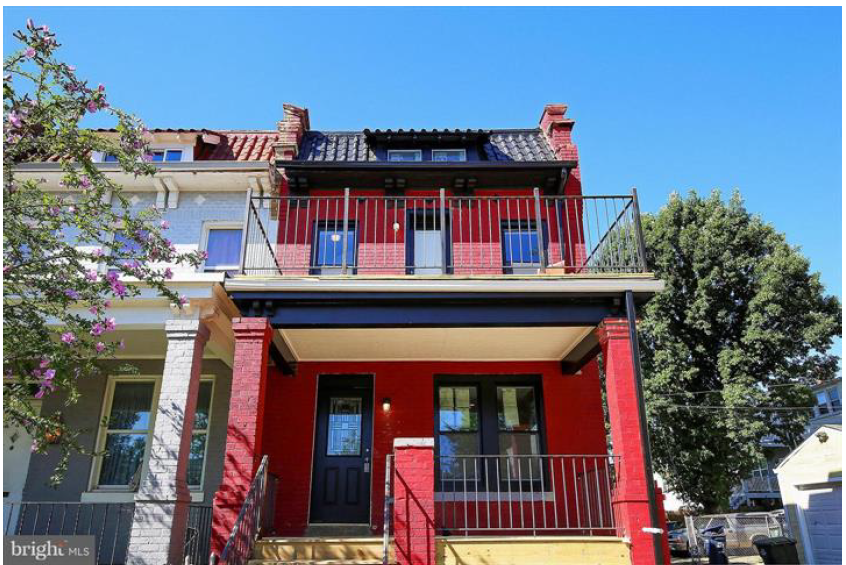

Childress St NE

Before: Who said “better dead than red”? The new exterior of this DC home looks amazing in red and black. And just take a peek inside.

Illinois Ave., NW

BEFORE: We are talking about FULL remodel! Nothing is spared as the old gives way to the new.

AFTER: No detail is neglected here. Airy and spacious, this home oozes nonchalant elegance with each floor, each room, and every finishing touch.

Hanna Rd, Washington, DC

Before: This investor turned an old cape cod in SE DC into a modern and airy home. We love the railing, don’t you?

New Funding Resources

New Funding Resources