48 Michael Ct Gaithersburg MD 20877 Offered at $150,000 Condo fee: $293 Rental Income: $1,600+ The only four-bedroom condo in the subdivision! Year built: 1973 Property type: condo/townhouse Levels: 2 levels Living area: 1,365 Assigned parking and plenty of visitors Bedrooms: 4 Bathrooms: 2 ½ CALL OUR SENIOR UNDERWRITER MELISSA FOR DETAILS. 240.436.2340 […]

Hard Money Blog: Invest, Revitalize, Create, Prosper

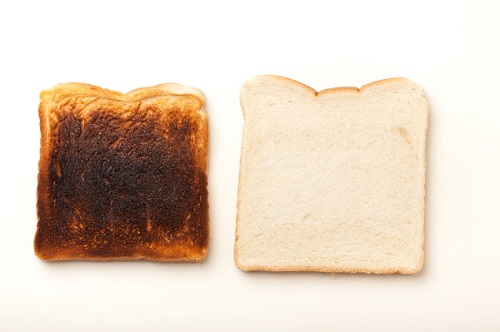

How To Estimate Your Rehab’s After Repair Value (ARV)

How To Determine the After Repair Value Without a Realtor

Let’s not beat around the bush. The best source of real estate information is the Multiple Listing System (MLS). Fortunately for the licensed real estate agents and unfortunately for the real estate investors who are not licensed, only realtors have access to it. The good news is that today you have more information than ever floating around. It might be not as nuanced as MLS’s, however, if used correctly, it can help you determine your rehab’s after repair value without a realtor.

Amazing Rehab in Opportunity! – SOLD

Gwynns Falls Pkwy, Baltimore, MD 21216 With questions, please call Melissa or Kyle at 240.436.2340.

How To Get Seed Capital For A Hard Money Loan

Among the many benefits of working with a hard money lender like us is the flexibility of our underwriting. Our hard money loans are not credit score driven, and we don’t verify our borrowers’ income. When it comes to borrower’s contribution to the transaction, we accept a more diverse variety of sources than traditional lenders.

Why No Money Down Hard Money Loans are a Pipe Dream

Hard money loans allow a real estate investor to effectively compete with cash offers while investing only a fraction of cash needed to purchase and rehab a property. Alternatively, hard money loans allow well-heeled investors who do have enough cash to buy a property outright to multiply their profits by investing in several properties at once. In their case, financial leverage that hard money loans provide allows them to operate on a large scale and make more money.

New Funding Resources

New Funding Resources