Why Smart Investors Buy in Winter to Sell in Late Spring

If you invest in real estate around Washington, DC, Maryland, and Northern Virginia, the calendar is not just a calendar. It’s a pricing environment.Seasonality is one of the most reliable “hidden forces” in our local market: buyer activity ramps up hard in spring, competition for listings increases, and renovated homes that show well tend to get rewarded with faster contract times and stronger pricing pressure.

So here’s the investor logic we want you thinking about in late January: if your goal is to list in late spring (or very early summer), your best move is often to buy now, while the market is calmer and your contractor schedule is still salvageable.

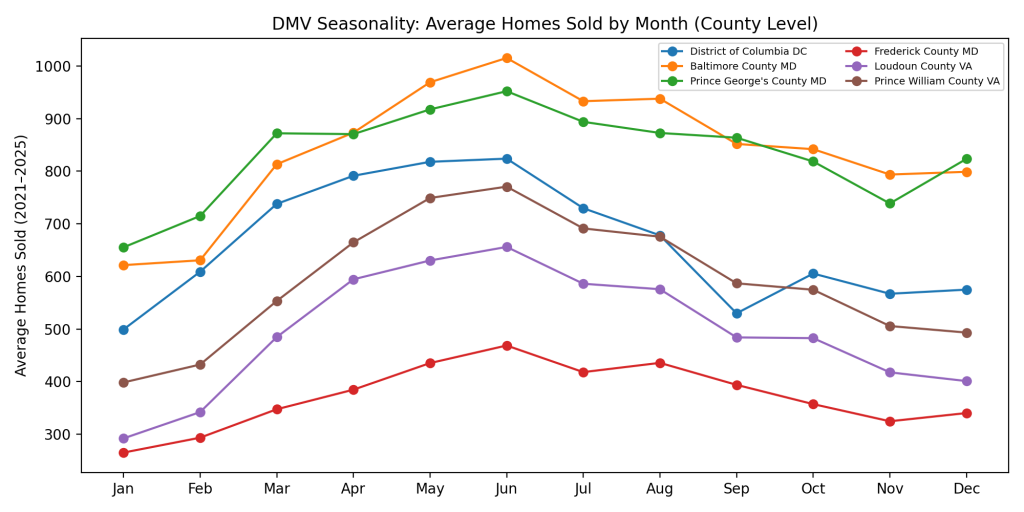

What the county-level data says: Spring is the action season

Using Redfin’s downloadable county housing market dataset (monthly, county-level) and averaging 2021–2025 seasonality patterns, we looked at “All Residential” sales for:

- District of Columbia (Washington, DC)

- Baltimore County, MD

- Prince George’s County, MD

- Frederick County, MD

- Loudoun County, VA

- Prince William County, VA

Result: In all six markets, the peak month for homes sold is June (on average, across 2021–2025).

That’s not a cute coincidence. It’s a pattern.

Average homes sold by month (2021–2025). All six counties peak in late spring/early summer

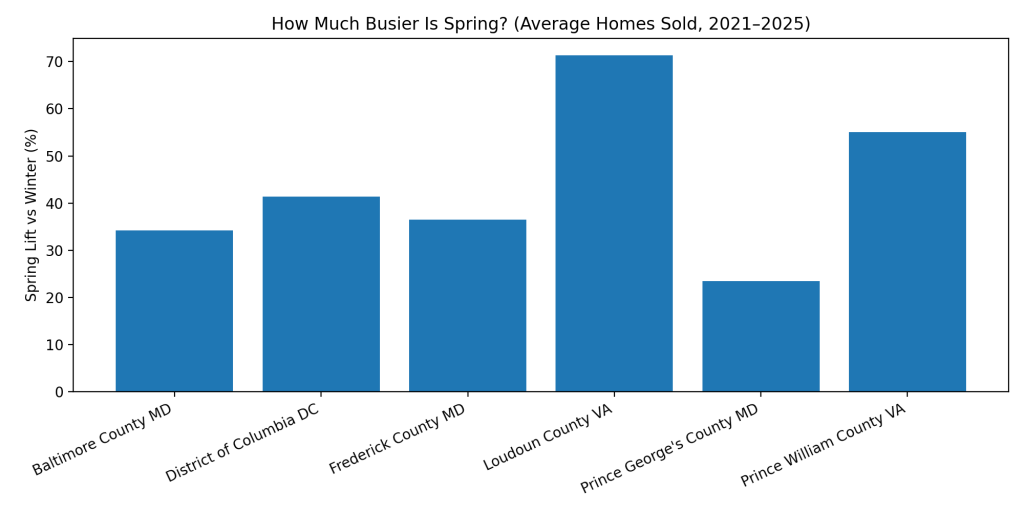

How much busier is spring, really?

To keep this easy to digest, we compared:

- Spring activity: March–June average homes sold

- Winter activity: December–February average homes sold

Here’s what we see in average sales lift from winter to spring (2021–2025):

- Washington, DC: ~+41% spring lift

- Baltimore County: ~+34% spring lift

- Prince George’s County: ~+24% spring lift

- Frederick County: ~+37% spring lift

- Loudoun County: ~+71% spring lift

- Prince William County: ~+55% spring lift

In plain English: your buyer pool expands in spring, and in some parts of Northern Virginia it expands dramatically.

Spring lift vs winter: average increase in sales activity (2021–2025)

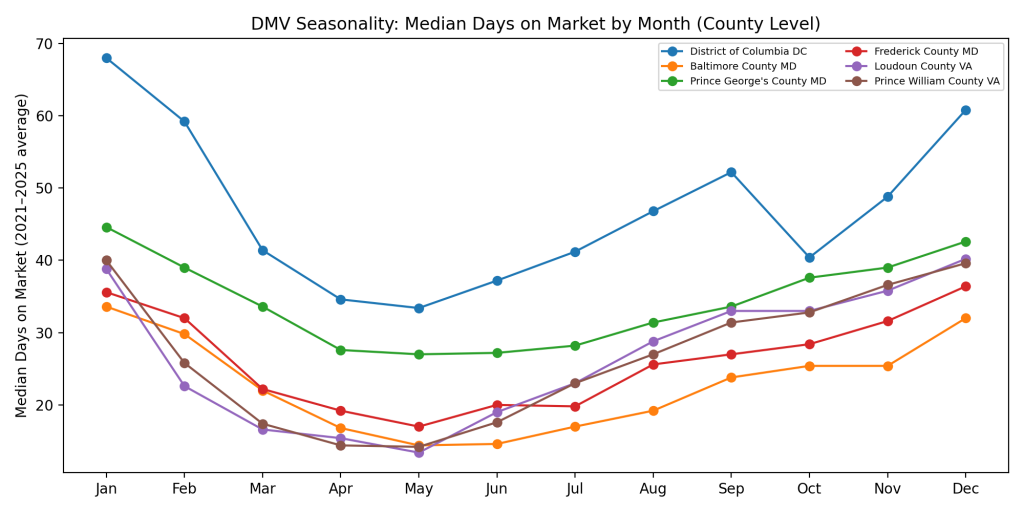

Days on market tighten in spring (which matters a lot for flips)

Sales volume isn’t the only seasonal shift. The other investor-relevant shift is days on market.

Across these same counties, median days on market are generally lowest in spring and higher in winter. Washington, DC is the most dramatic example: median DOM averages are much higher in winter than spring.

Why investors should care:

- Shorter DOM often means cleaner comps (less “stale listing” discounting)

- Appraisers see more relevant, recent closings

- Buyers feel urgency (especially in “pretty house” seasons)

Median days on market by month (2021–2025 average). Spring tends to move faster

The investor playbook: buy now, renovate through winter, list into the spring wave

If you’re reading this in late January, here’s the timeline strategy that tends to fit the DMV’s seasonal rhythm:

Step 1: Acquire during the calmer months (now through early March)

Winter typically brings:

- fewer retail buyers touring open houses

- fewer bidding wars on “lipstick listings”

- more sellers willing to negotiate repairs, credits, or price

This doesn’t mean it’s “easy.” It means you’re shopping in a quieter aisle of the grocery store.

If you’re using private financing to move fast, this is where private money loans can help you secure the deal before spring competition heats up.

Step 2: Renovate while contractors still have bandwidth

Contractor scheduling is seasonal too. As soon as spring flips start stacking up, trades get booked, timelines stretch, and “two-week delays” start breeding like rabbits.

Step 3: List when buyer demand is naturally higher (late spring into early summer)

Your goal is to have:

- punch-list done

- photos done

- landscaping done

- staging done (even light staging)

- and the house ready when the market is busiest

Because the data is blunt: spring is when the most buyers show up in DC, Baltimore County, Prince George’s, Frederick, Loudoun, and Prince William.

The quiet takeaway (the one that makes money)

Spring is loud. Winter is quiet.

Investors get paid when they do the important work in the quiet season and show up with a finished product when the market gets loud again.

If you want your renovation completed in late spring, the math is simple:

- Buy now

- Start the scope now

- Lock your contractor schedule now

- And aim to list into the seasonal demand wave

If you want to pressure-test a deal quickly, call us today at 240-436-2340 or get pre-approved with us here.

Data source note

All seasonality charts and the spring-vs-winter comparisons above are calculated from Redfin’s downloadable county-level monthly housing market dataset, using 2021–2025 monthly averages for “All Residential.”

New Funding Resources

New Funding Resources

Leave a Reply