To be a successful investor, you have to wear different hats comfortably. You’ve got to know how to hire and manage people. You’ve got to understand the intricasies of the construction business. You must be a student of local real estate market. You need to have excellent time and money management skills. Perhaps most importantly, you need to be able to find profitable real estate deals. As a private lender, we see our borrowers successfully employing many different strategies to do that. This article is Part 1 of our series on finding real deals.

One of the popular venues for acquiring an investment property is an auction. As a private lender, I’ve seen investors securing amazing deals at auctions. However, buying at an auction requires you to be well-capitalized and can tie up your personal funds for a long time. You need to understand how auctions work and how to participate in them without overexposing yourself to too much risk. That means knowing how much to bid and when to walk away.

How the Real Estate Auctions Work:

A property ends up at an auction for one of two reasons: It’s either been foreclosed because its owners stopped making their mortgage payments or they are severely delinquent on condo fees. Many auctions happen at a local government courthouse or some even at the property’s premises.

The starting price at the auction might vary, but often, it is the balance of the mortgage secured against the property. If no investor bids higher than that, a foreclosing lender takes over the property, often at a loss. The property becomes “bank-owned or REO.” At that point, the bank is free to do whatever it wants with it. Most frequently, the bank would list the property on the open market – whether in its current condition or after some sprucing up to make it look better.

Alternatively, the auction might spark lively bidding and sell the property to the highest bidder. Before leaving the auction, the highest bidder will be required to put down a specified earnest money deposit, usually between3% to 10% of the final purchase price. The highest bidder will not become an official owner of the house until the sale gets ratified by the court and an actual closing takes place. The ratification process might take months, depending on the county and particular property. It all depends on how many other foreclosure cases are going through the court system at any given time. Ten years ago, when the market was still recovering from the housing crisis, it was not unheard of for some cases to take up to a year. Things have calmed down a bit since then, but you should expect at least a couple-month wait for your purchase to be ratified.

What You Need To Participate In an Auction:

The good news is that you don’t need to pre-register to participate in the auction. You can just show up. However you need to know where and when an auction takes place and have three things: (1) time; (2) earnest money; and (3) funds to purchase the property once the sale gets ratified.

You Need to Know Where and When Auctions Take Place:

A handful of auctioneers handle most of the auction work. Check online. For example, one of the major auctioneers in Maryland is Alex Cooper. Their website has a complete listing of upcoming courthouse auctions, so you can start checking out potential properties.

You Need Time Flexibility:

The majority of auctions take place during the week and during regular business hours. The auctioneers don’t make it too convenient. They might hold an auction for two properties you are interested in at 9:00 am and another auction for another property you want to bid on at 11:00 am. On one hand, you have to be ready to spend your entire morning at the auction. On the other hand, you have to be prepared for any auction to be canceled right before it starts.

Earnest Money:

If you are the highest bidder, you must put in an earnest money deposit. An earnest money deposit varies from property to property and can range from $3,000 to more than $30,000. An earnest money deposit is specified in advance and is required in a cashier’s check. That means that if you are planning to bid on two properties, you need to have two certified checks in your pocket – one for each property. You can use any source of funds for your earnest money deposit. However, it’s important to remember that private lenders do not finance those deposits. They must come from your own funds. These funds will be counted towards your contribution at the time of closing.

Loan Pre-Approval or Proof of Funds:

Let me be very clear: You are not required to bring any letter of pre-approval or proof of funds to the auction. Your earnest money deposit guarantees that you are serious about purchasing the property. If, for some reason – almost any reason – you cannot buy the property, you will lose your earnest money. This is why if you are planning to make a bid at an auction, it’s essential to have a solid pre-approval from a reputable hard money lender. Since private lenders’ underwriting is heavily focused on collateral, you have to be reasonably sure you are getting a good deal. This brings us to another critical aspect of making money at the real estate auctions: your bidding strategy.

Planning Your Bidding Strategy:

If you win the right to purchase the property, you must buy it or give up your earnest money deposit. If you later discover that the property has a cracked foundation – too bad; you are still on the hook. That means you must do as much analysis as possible before getting to the auction.

The analysis can be tricky. Some auctioneers allow brief access to the property before the auction, but many just publish the property description, such as the type and square footage. You might not know the property’s actual condition. In some respects, buying a property at the auction is like shooting in the dark and hoping for the best. Still, you’ve got to try your best.

At the minimum, do a detailed analysis of similar properties sold in the immediate neighborhood. Look at the properties that are both distressed and not in the best condition and those that have been rehabbed. If you have time to drive to the property and look at it, do it – even if it’s from the outside only. Peek through the windows and try to assess the property’s condition. See if the property being foreclosed on is occupied or vacant. This can influence how quickly your sale can be ratified by the court. Remember, the goal of your analysis is to determine the maximum amount you are willing to bid.

Knowing When to Walk Away:

The most important thing you can do for yourself is to know when to stop bidding and walk away. Your goal is not to overbid the other guy. You are not an art collector bidding on a Picasso at Sotheby’s against another mogul just because you like it. You have a single goal in mind – to make money in real estate.You shouldn’t get emotionally involved in the process. Yes, you may spend a chilly January morning freezing your butt on the court steps and have nothing to show for it at the end. However, it’s much better than to walk away with a property that would later drain you financially and emotionally.

One of the great things about buying at an auction is bidding on distressed properties. If you are patient and keep showing up at the auctions day after day, you can walk away with amazing deals. Auction buying is all about discipline and sticking with your numbers.

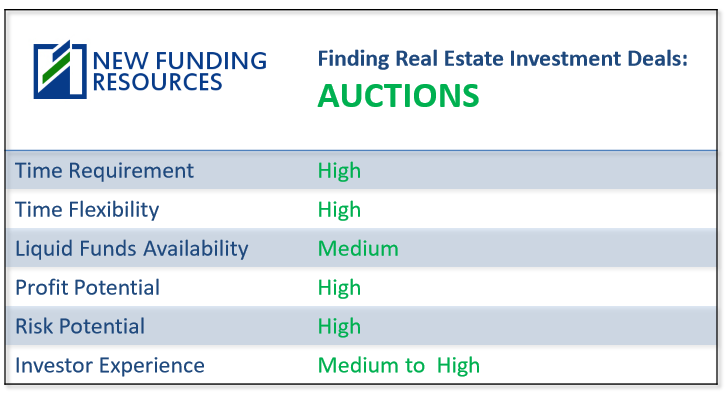

Here is the summary of the pros and cons of buying an investment property at the auction:

New Funding Resources LLC is a premier private lender that funds promising real estate investment opportunities in Maryland, Washington, DC and Virginia. You can apply on line or call 240.436.2340.

New Funding Resources

New Funding Resources

Leave a Reply