Debt Service Coverage Ratio (DSCR) loans are a popular financing option for real estate investors who want to build rental portfolios without relying on personal income verification. Instead of focusing on tax returns or W-2s, DSCR lenders evaluate whether the rental property itself generates enough income to cover the debt.

In short: your rental income—not your paycheck—qualifies you.

How DSCR Loans Differ From Conventional Loans

Conventional loans require borrowers to prove their income, maintain a low debt-to-income (DTI) ratio, and provide tax returns and pay stubs. For many investors juggling multiple properties, those requirements become a barrier to growth.

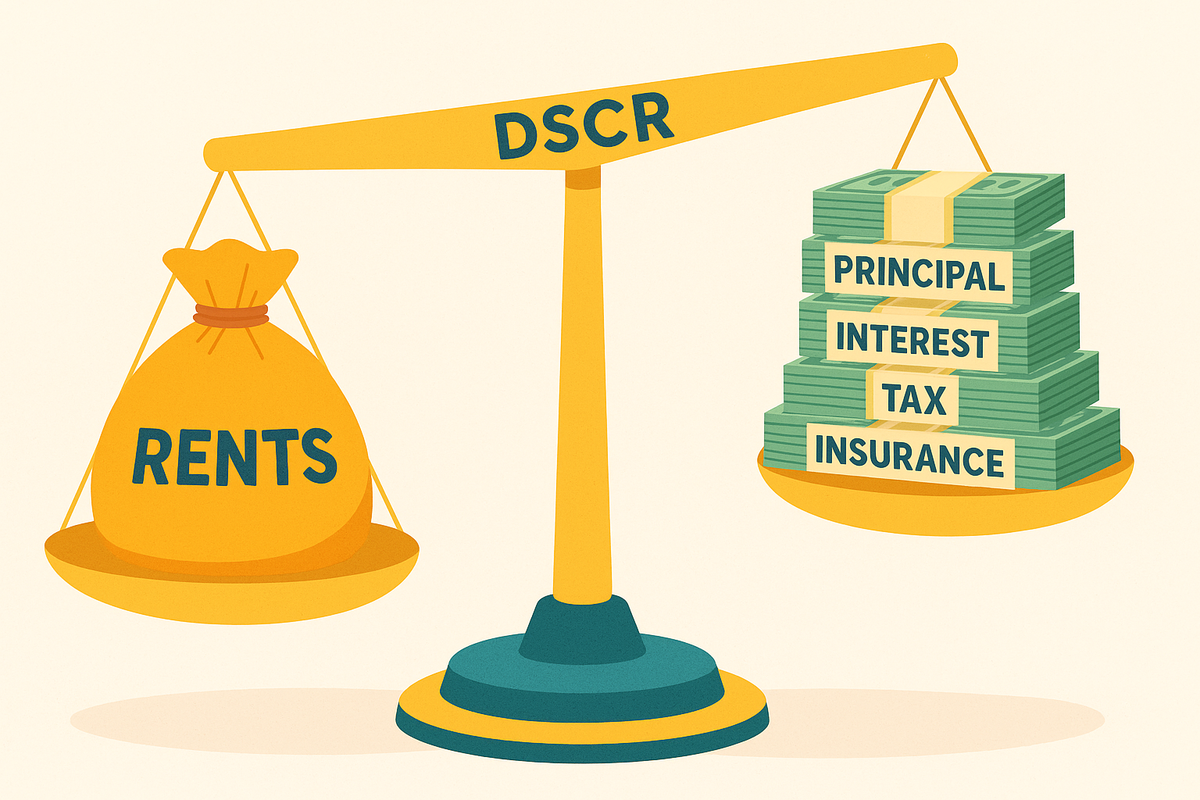

DSCR loans flip that script. Instead of scrutinizing your personal finances, lenders look at the property’s Debt Service Coverage Ratio (DSCR):

DSCR = Gross Rental Income ÷ Monthly Debt Payments (Principal + Interest + Taxes + Insurance)

A DSCR of 1.0 means the property just covers its costs, while a DSCR of 1.2 or higher is usually required to qualify comfortably.

How DSCR Loans Differ From Hard Money Loans

Both DSCR and hard money loans are tools for real estate investors, but they serve very different purposes. Hard money loans are typically short-term—six to eighteen months—and are designed to help investors move quickly on distressed properties. They are based on the After-Repair Value (ARV) of the property, not the borrower’s income. Payments are interest-only, and no income verification is required.

DSCR loans, on the other hand, are structured for the long haul. They usually come in the form of 30-year fixed or adjustable loans and are tied directly to the property’s ability to generate rental income. While hard money loans help you acquire and renovate, DSCR loans are intended to help you hold and cash-flow long-term.

DSCR Loan Underwriting Requirements

Though DSCR loans are more flexible than conventional financing, they still come with certain benchmarks. Lenders typically require a DSCR of 1.0 to 1.2, depending on the property and market conditions. Credit score minimums also apply: 620 is generally the absolute floor, and even then only if the borrower has sufficient equity. Investors with stronger credit scores will find better terms available to them.

Interest rates for DSCR loans are higher than those for conventional mortgages, reflecting the greater risk profile of investor-focused lending. You shouldn’t expect the “rock-bottom” rates you see advertised for primary residences, but competitive terms are available for investors with solid properties and rental histories.

Lenders also want to see that the property has a proven track record of generating rental income. In most cases, that means the property must be rented for at least three to twelve months before it qualifies. Some lenders may accept projected market rents for newly acquired properties, but this usually comes with stricter terms.

In addition, investors should be prepared to bring 20–25% down to the table and provide lease agreements and appraisals as part of the documentation package. While DSCR loans eliminate the need for personal income verification, they are still underwritten carefully to ensure the property can stand on its own.

Common Hurdles in Getting Preapproved for a DSCR Loan

Many investors are drawn to DSCR loans because of their flexibility, but the preapproval process can still present challenges. The most common hurdle is that the property’s rental income doesn’t add up. Even if a home looks good on paper, if the rents don’t sufficiently exceed expenses, the DSCR will fall short of the lender’s requirements.

Another obstacle comes with newly acquired or recently renovated properties. Without a rental history, lenders may insist on using market rent projections. While this is possible, it often results in tighter restrictions or less favorable terms. Credit scores also play a major role. A borrower with a score below 620 is unlikely to qualify, and even at 620, the terms may be less attractive unless the property has a significant equity cushion.

Finally, many DSCR lenders require investors to maintain cash reserves to cover several months of payments in case of vacancies. Prepayment penalties are also common, which can limit your flexibility if you plan to refinance or sell early.

Where New Funding Resources Comes In

At New Funding Resources, we focus on what we do best: providing competitively priced short-term financing tailored to the needs of Maryland, Virginia, and Washington, DC real estate investors.

Our private loans are based on the property’s After-Repair Value (ARV), feature interest-only payments, and close quickly with no income verification required. They’re the ideal tool for acquiring and renovating properties in a competitive market.

We do not offer DSCR loans directly. However, many of our borrowers use our hard money loans to acquire and renovate properties, and then refinance into DSCR loans once the property is stabilized. If that’s your strategy, we’re happy to connect you with reputable DSCR lenders we know and trust.

Call us today at 240-436-2340 to learn how our short-term loans can help you secure your next investment—and how DSCR loans may support your long-term rental portfolio.

New Funding Resources

New Funding Resources

Leave a Reply