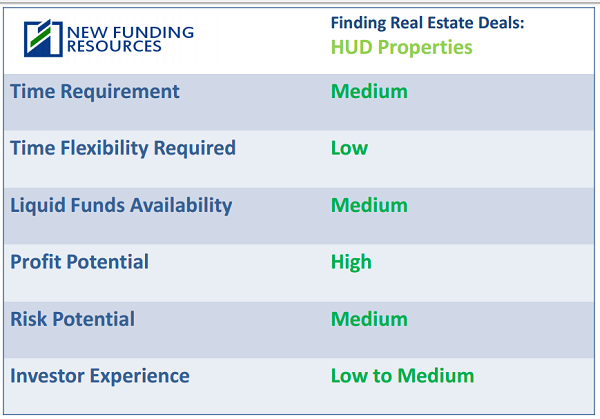

This article is continuation of our series on finding profitable real estate deals. We’ve already discussed the REO route and its pros and cons. However, there is one type of REO that is quite different from the rest. In my experience as a private mortgage lender, this route offers unique opportunities for real estate investors. I am talking about HUD properties. Such opportunities don’t come often, but some of the most profitable rehabs we’ve seen came via HUD properties.

What are HUD homes?

HUD homes are properties repossessed by the US Department of Housing and Urban Development (HUD) because the previous owners defaulted on their FHA mortgages. However, this is where the similarities with other REOs end. If you are an investor interested in purchasing a HUD property you need to know the differences between a regular REO and a HUD property and be able to take advantage of these differences.

How can investor find a HUD home?

HUD sells its properties through local real estate agents. HUD lists them in MRIS, but the easiest way to find them is to go to www.hudhomestore.com. To find the right HUD property, you need to:

- Set Your Criteria: Use the search tool on the HUD Home Store website to filter properties by state, city, ZIP code, price range, and other factors. Since there are not many HUD properties at any given time, inputting individual zip codes might not return results. This is why I recommend using map search and highliting a specific area you are interested in.

- View Listings: The search results will display available properties, including details like the address, price, number of bedrooms and bathrooms, and property condition. You can also view photos and download property condition reports.

How can investor make an offer on a HUD property?

HUD’s government mandate is to promote home ownership. HUD sticks to this mandate even with its foreclosed properties. The main difference is that HUD gives priority to buyers who are planning to occupy the property and lets them bid on its properties first. Investors like you would not be able to bid until certain amount of time goes by. Depending on the property, that period might range from 5 days to 15 days. Check with your real estate agent on details, but the rule of thumb is that you can bid on the 6th day when it comes to HUD homes that are not FHA-insured and on the 16 day for the FHA-insured homes. The Hudhomestore site would provide you with the information on whether the property is insured or not.

Though at first glance such system appears to discriminate against investors, the truth of the matter is that many properties sit on the market for longer than that. HUD is a motivated seller who changes its price at least every two months. The price change doesn’t trigger a new owner-occupied-only bid period allowing investors to compete unencumbered of any restrictions. Keep in mind that you must have an agent who is affiliated with a HUD-approved real estate broker to make an offer. As a private mortgage lender I would also recommend taking it a step further and working with a real estate agent who is intimately familiar with the HUD process. As we’ve already discussed, buying a HUD property is quite different from buying a regular REO. Your agent needs to know how to navigate the process successfully.

Why HUD properties are good for investors?

HUD bases its asking price on a market value determined by independent appraisers. I am not sure why but many properties I’ve seen have been priced on the lower spectrum of their market value. In addition, many properties are not in the best shape and require at least $5,000 in repairs which deters many owner-occupied buyers and makes them ineligible for many types of financing. If you find a property you like, watch it like a hawk and hope it makes it through the owner occupied bid period. If it does, you might score a great deal.

Just like with any property, the longer it sits on the market the more its owner – in our case, HUD – is willing negotiate. HUD might be willing to accept a lower price on a property that sits on the market for more than two month as it considers it “an aged asset.”

As a private mortgage lender, I see several elements that are essential for scoring a great deal on a HUD property.

How to get a good deal on HUD properties?

First, it’s the right choice of the neighborhood. Truth be told, there are a few HUD properties in the upscale neighborhoods such as Bethesda and Chevy Chase. These are established areas with stable prices and HUD knows it. They are unlikely to discount such properties to the extent that would make them profitable to a typical investor.

On the other hand, there is always a pool of properties from distressed areas such as certain neighborhoods in Baltimore. It’s true, HUD might be willing to negotiate on those homes. However, as any private mortgage lender would tell you that there are multiple risks in investing in such areas. At times, even the discounted price might not be enough to compensation for them. Instead, choose an in-between area that offer affordable housing without being surrounded by board-ups. Concentrate on the areas that you know and are comfortable with. Look for the up-and-coming areas or pockets of the well-established neighborhoods that are historically discounted.

The second component is time. Though watching the HUD site for the right property to bid on is not too time consuming, it requires perseverance. Compared to other REOs, HUD has a relatively small pool of properties, especially if you narrow your area.

Challenges of Buying HUD Properties in the Washington, DC area

The main challenge of buying an investment property from HUD is that there are so few of them nowadays. FHA mortgages are risky because of their low downpayment requirements, but the days when there was a glut of FHA foreclosures are gone. I ran a search for the HUD properties in August 2024. There were eight properties in Maryland listed for sale, one in Washington, DC, and twenty-one in Virginia (with the majority of those being in the rural southern areas of the state). Quite different pictures from early and mid-2010, when the HUD inventory was abundant.

Why work with private mortgage lender while purchasing a HUD property?

Speed. Once you’ve identified the property you are interested in, you have to watch it closely and move fast. Chances are other investors are interested in it as well. You need to stand out from the crowd. Two ways of doing it is to convince a seller that you can close fast and with no issues. You want to submit your offer ahead of them which means as quickly as possible after it comes out of the owner-occupied bidding period. Talk with your real estate agent on the best way to structure an offer and stay on top of him or her to make sure your offer is submitted in a timely manner. Remember to include in your offer that you are working with a private mortgage lender like New Funding Resources. Your offer with us is equivalent to a cash offer and we can close within days not months.

New Funding Resources

New Funding Resources

Leave a Reply