Do you like sushi? I do, and a couple of weeks ago I got a party tray from a local sushi place. It’s a decent deal – feeds 6 people with generous leftovers for $75. We liked it so much that this week we decided to order it again. Except, I could no longer find that tray for $75. I called the restaurant for help, and the owner informed me that they had to increase its price from $75 to $90.

Yes, Jerome Powells, when a tray of sushi goes up in price by 20% in two weeks, it’s time to drop “transitory” as a description of the inflation we are living through. “Shocking” might be a better term for someone trying to feed a family. Or, perhaps, “befuddling,” if you are a real estate investor trying to decide on your strategy for the next year. So let’s talk more of what “befuddles” the experts and the novices alike: How the DC real estate market will stand up to inflation? Perhaps more importantly, is it still possible to make money investing in it in 2022?

First, let’s stand back and gain some perspective on today’s inflation. One of the most common economic indicators of inflation is the Consumer Price Index. When the Consumer Price Index (CPI) rises above a certain level it might indicate inflation. When it declines, it’s called deflation. It’s generally accepted that the CPI will increase year after year. However, economists generally believe a “good inflation” to fall between 1.5% and 2% annually. This “good inflation” is what we had for the last ten years. From 2011 to 2020, the CPI increased on average by 1.75% annually giving the policymakers, the economists, and the consumers few reasons to worry.

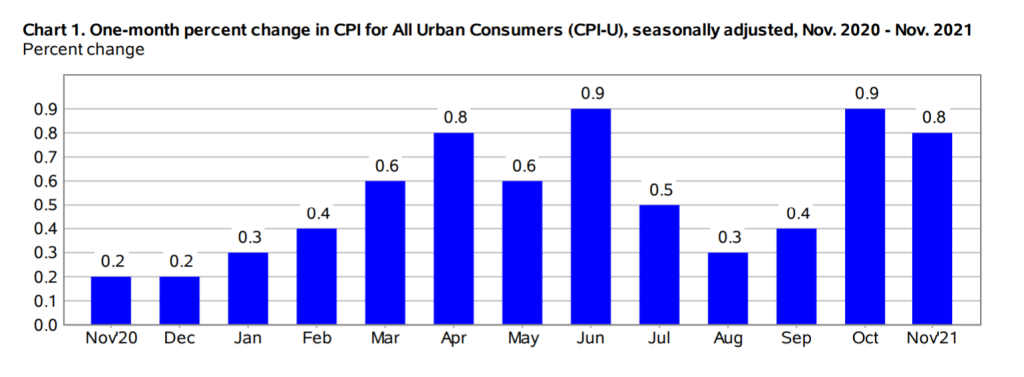

Not this year. If you look at the chart below, monthly inflation rates for June and October 2021 begin to approach the annual inflation rate for the entire 2020 (1.2%).

As of November 2022, the 12-month increase in the Consumer Price Index reached 6.8% making it the single largest increase since 1982. 1982 was the tail end of the turbulent economic times referred to as the Great Inflation – the defining macroeconomic event of the second half of the twentieth century. The struggle to control inflation led to transformative changes in our understanding of microeconomics, the role of the Federal Reserve, and its current monetary policies. The hope is that we’ve learned enough in 1982 to nip the inflation in the bud in 2021.

The understandable anxiety stems from the fact that what worked forty years ago may no longer work today. The world changed drastically since 1982. Though there are some stark similarities between the forces behind that past inflationary period and the one we currently live through they might be superficial.

So what are the most cited reasons for today’s inflation?

Pent-Up Demand

Investopedia defines pent-up demand as a rapid increase in demand for a service or product, usually after a period of subdued spending. There is no better example of “subdued spending” than the Covid-19 shutdown. Though pent-up demand can cause a temporary spike in inflation (especially after so many businesses slashing their prices in 2020), its effects are bound to be short-lived. At the very least, they should have dissipated by now as the economy reopened almost a year ago.

Increases in Energy Prices

When gasoline increases a dollar a gallon in one year and is priciest than it’s been in seven years, it is easy to see it as the main culprit behind the current inflation. And many do. Many sources cite increased energy prices as the main driver of inflation. Energy commodities (oil and gasoline) increased by almost 60%, making them the two Consumer Price Index Categories with the highest inflation rates. Those increases spread throughout the economy making anything that is manufactured and shipped more expensive. And with the winter heating season upon us, the energy prices are bound to extoll even a higher toll on all of us.

Supply chain imbalances

It’s pretty bad when the lumber prices cannot get off their crazy roller-coaster ride, and the lumber shipments are being delayed for months. However, when the New York bagel shops cannot get enough cream cheese, this is a national disaster. The shmear shortage hits closer to home than any other commodity ever could. President Biden can blame it on supply-chain bottlenecks and price-gouging by Zabar’s, but when there is nothing but hummus to top your bagel, we all know “The Winter is Coming.”

Excessive Monetary and Fiscal Stimulus

I do believe that we eventually figure out how to overcome the supply constraints and that cream cheese will flow again upon those New York City bagels. We will pump up the US natural gas productions and convince Russia and the OPEC nations to step up their oil production. What will continue to drive inflation, however, is the excessive stimulus of the already overheating economy. Let’s be frank: for the last two years, we as the nation have been practically living off the government. The American Jobs and Infrastructure Act will add another $1 trillion to the already astounding debt. In addition, since much of the infrastructure plan is aimed at job creation, it has the potential to aggravate already dire labor shortages in many industries. Inflation drives the prices up, which, in turn, reinforces high wage expectations. We are trapped in the vicious cycle unless we agree on policy solutions that stop the money printing, curtail government borrowing while judiciously spending on the programs with the highest long-term growth potential.

Knowing today’s combative political environment, I assume this is exactly where we would get stuck. And since we are not here to solve the government problems, let’s concentrate on how this situation can affect our core expertise: real estate.

How does inflation affect real estate?

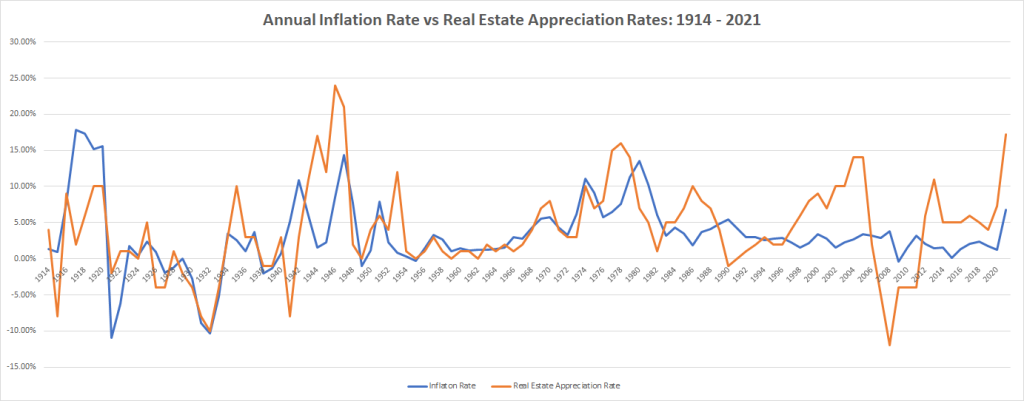

Savers with money in the bank typically take on the brunt of inflation. Real estate, historically, offers a hedge against inflation. Take a look at the chart below that tracks annual inflation and real estate appreciation rates.

Almost every time inflation spikes, it’s closely followed by an increase in real estate prices mitigating its effects – at least to some extent. According to the Wall Street Journal, homeowners also weather the inflationary periods better than stock and bonds investors.

While we can reasonably expect real estate to at least keep up with the inflation, that is not to say that it’s good for real estate investors. The runoff prices might make it difficult to snatch a good deal for those pursuing the fix-and-flip strategy. Those with real estate portfolios might find it more expensive to maintain their properties. But unless Covid-19 mutates into something more sinister than Omicron and any other natural or man-made disaster aside, 2022 should be a typical year with its own challenges and opportunities.

What would influence real estate investing in the inflationary environment of 2022?

The Fed Raising Rates

This month the Federal Reserve moved into full inflation-fighting mode hinting at numerous upcoming rate hikes. One of the hopes of raising rates is to dampen consumer spending. The logic behind it is that higher interest rates would make it more appealing to save rather than to spend helping to end the inflationary cycle.

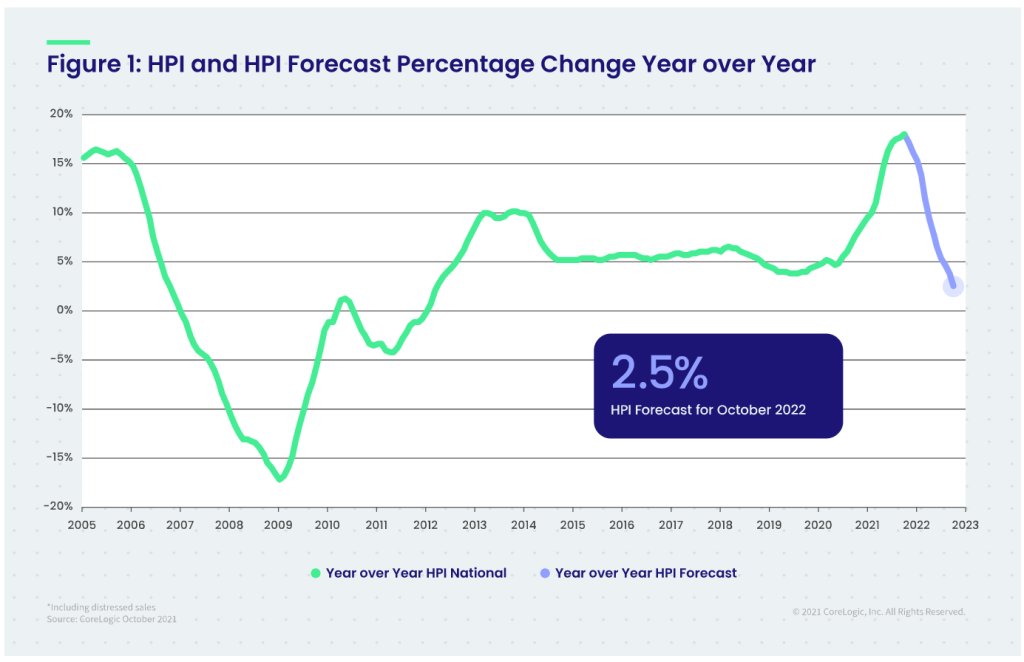

However, higher interest rates also make borrowing more expensive. And because the majority of homeowners and real estate investors rely on borrowed funds, it makes buying real estate more expensive. Though the rate hikes are bound to put downward pressure on real estate prices, the good news is that few experts expect the real estate prices to drop. CoreLogic Home Price Index (HPI) is notoriously conservative, but even it calls for the 2.5% real estate appreciation rates in 2025. Not much to write home about but enough to at least offset inflation partially.

Stock Market Volatility

Some experts accuse the Fed of having a history of being too slow to remove stimulus following economic recoveries. They also argue for more decisive actions resulting in more aggressive rate hikes. If the Fed indeed takes this course, it might lead to stock market volatility and declines. Turbulence on the market might make the relative stability of the real estate sector more attractive to investors and first-time buyers alike – helping sustain the real estate appreciation rates.

Debt Debasement

If you’re a highly-leveraged landlord, here is good news for you. Your current debt becomes cheaper as inflation increases. For example, let’s take this year’s inflation of 6.8%. If you borrowed $500,000 in January 2021, your current debt in today’s dollars equals 93.2% (100%- 6.8%) of inflation-adjusted dollars. Effectively, instead of $500,000, you now owe $466,000. Of course, this is only the good news for the landlords who already purchased a property and don’t have to deal with the high-interest mortgage rates predicted for 2022.

Higher Renovation Costs

Both higher costs of materials and higher costs of labor will contribute to their higher rehab costs. The increases in lumber prices were at one point this year adding almost $36,000 to the price of single-family home construction. While the lumber prices are likely to stabilize in 2022 and other bottlenecks resolve themselves, the higher labor costs are here to stay.

Higher Rents

Rents are on the rise and will likely continue to increase in 2022. In October 2021, Corelogic reported a national rent increase of 11%, the fastest year-over-year increase in over 16 years. Zillow’s Observed Rent Index rose even higher to 14.3%. This is the aspect of inflation that undoubtedly benefits those earning income from their rental homes. If you’re able to adjust your rent up while keeping your mortgage the same, you definitely will be adding money to your wallet in 2022.

Investors Must Be Better Capitalized

When prices go up, you need more money. As real estate continues to appreciate and renovations become more expensive, you must have more of your own funds to invest. Private lenders like New Funding Resources are unlikely to curtail their lending or dramatically change their underwriting criteria. While the required contribution percentage might be the same, in absolute numbers, it becomes more expensive to be a real estate investor.

Less Real Estate Investor Competition

Unfortunately, not everyone’s income will rise to compensate for inflation. Folks would continue spending more on food, utilities, clothing, entertainment, and shelter. It will all make it harder to save and have required reserves to safely invest in real estate. As the result, for the first time in many years, 2022 has the promise of less competition, deescalating price wars, and more investment opportunities for those able to afford it.

Washington DC Metro Real Estate Market and Inflation: What’s Next?

Last year, CoreLogic, which I love and respect, called for at least a 5% decline in our local market. Instead, in November 2021, Washington, DC home prices were up 6.7% compared to last year, selling for a median price of $729K. Year after year, often despite better judgments, the prices in our neighborhoods go up. It looks almost unsustainable, but yet the trend continues. I believe (and you can read more in our previous article about the state of the Washington, DC real estate market here) that we continue to be sustained by the region’s dependency on Federal or government-contracting jobs. Amazon is not the only high-paying employer that has moved here. The pharmaceutical industry, buoyed by our newfound virus awareness, is thriving and hiring. In the most educated region in the country, the local workforce is in demand and can effectively leverage that demand in high-paying and stable jobs. The mortgage underwriting fundamentals are here and ensure that borrowers can afford to pay their mortgages in the long run.

So here is my prediction for 2022. It will be hard to return to the healthy rates of inflations we’ve seen in the past 10 years. The Fed will work diligently to bring them down, but it would be a while until we see the rates in the 2%-range again. The inflation might hover above 4%, and the local real estate market will have no issues keeping up with it. The inventory will remain tight possibly driving the appreciation beyond the inflation rates. The work-from-home policy will continue to escalate price increases in the far-flung suburbs and in the vacation areas such as Deep Creek Lake and Lake Anna. Rents will continue to rise.

New investors with low capital will find the entry costs too high, potentially reducing the competition for distressed homes. Investors with plenty of income will prefer the buy-and-hold strategy, both because of the narrowing margins for fix-and-flips and their focus on long-term appreciation.

The best time to invest in real estate is always in the past. No one knows what the future holds. But behind those barriers of uncertainty ultimately lie opportunities to build wealth for years to come. Happy New Year of 2022.

New Funding Resources

New Funding Resources

Leave a Reply